The Collapse of Antiquity

D**R

History repeats itself: First as tragedy, Second as farce

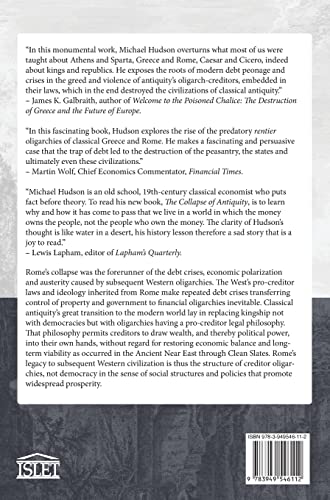

In an enlightening, informative, and incredibly relevant perspective on how Antiquity collapsed, Michael Hudson reveals that the Greek and Roman civilizations collapsed was not an overextended empire, but Antiquity’s inability to conduct debt cancellations or to regulate itself from corporate takeover of its government, or as Hudson terms it, the rentier class. It was this failure to control the rentier class that would lead to the collapse of the Roman Empire due to the failure of absolving debts, a die-hard insistence on paying debts that would become unpayable, and a declining tax base due to the citizenship falling into debt slavery. The book is organized into three sections; the first section discussing Ancient Greece’s rise and fall, then Rome’s rise and decline, and the last section about the fall of the Roman Empire and what it means to the modern world. Hudson traces the foundations of Greek and Roman economics from financial transactions conducted between the Greeks and the Near East/Mesopotamian Kingdoms. In an earlier work, …and forgive them their debts, Hudson states that the reason that the Mesopotamian kingdoms were financially and economically stable was that the kings would conduct “Clean Slate” laws that would wipe out all and any debts that were made. Echoes of “Clean Slate” laws were also made by Jesus, calling for a Jubilee Year among his subjects. The Greeks and Romans, on the other hand, did not conduct any “Clean Slate” laws or initiate Jubilee Years (the Greeks had at one point, but failed to conduct it regularly, nor reform the system so that debt would not be so predatory), but saw how high the short-term gains were from keeping debts intact. Thus, a centralized state was either gutted or made to serve wealthy interests along with a need to expand its base to continue the debt payments and the influx of slavery. The Greeks fell because of its failure (and self-brainwashing) to cancel debts, stripping its public finance and infrastructure and eventually voluntarily selling itself to Rome just so debts would not be cancelled via a revolution. Rome fell because its tax base could not possibly pay such enormous debts, its subjects forced into serfdom as a means of paying their debts. The barbarians at the gates (who have always been at the gates) did not destroy Rome. Rather, as Hudson brilliantly argues, Rome destroyed itself via debts. Its desperate search for payments made the Roman Empire more brutal, autocratic, and relentless towards its citizens that average Romans joined the barbarians just to escape the oppression and soldiers rallied around warlords who promised them a check (said warlords would pillage the cities and the countryside, also looking for money). Hudson uses a wide variety of resources for his work, all ranging from classical literature and from the late 19th to 20th century. For the average history reader, the classics are good, but one should appropriately become skeptical when an author uses non-contemporary resources. Hudson brilliantly argues that the classical histories often talked about the dangers of greed, debt, and the selfish drive to obtain more money and that this message has often been ignored by contemporary historians and economists who find parallels between a collapsing Roman Empire and the collapsing Western world too uncomfortable to publish (that and potentially being fired by their bosses). Late 19th and early 20th century economists understood the dynamic, saw the parallels, and wrote about it, which is why their works are referenced in The Collapse of Antiquity. Throughout the book, the reader is constantly being hammered in the head that the collapse of Ancient Greece and the Roman Empire is disturbingly similar to the many problems that the Western World, especially the United States, is facing. To me, it does not come off as annoying. Such reminders make me find parallels around the town that I live in (northeast Texas) and make me truly understand what I am living through. I can see businesses struggling to stay afloat, jobs that do not pay well (or even if such jobs exist) with employers placing ridiculous amounts of qualifications in their applications (or a reluctance to hire), roads and public infrastructure neglected and collapsing, inflation constantly climbing upwards, people withdrawing themselves from their surroundings to video games and cheap food, police forces trying to do their job with increasing brutality in a land that’s ever getting poorer (which encourages crime just to get by), public funding not being used to improve what we have here but instead for wars abroad. And to top it off, landlords; the rentier class using any means necessary to extract as much wealth as possible from the land that they own. It is all a quest for short-term gains. And when the money runs out (lets see if we’ll default at the end of this month!), then what? Reading The Collapse of Antiquity will make you uncomfortable, making you want to further understand how the world works and what is the solution. Hudson has a solution from antiquity and its modern parallels, but it is best to let the reader find out for himself. For those who have not read The Collapse of Antiquity, do yourself a favor and by a copy and read it now. You do not have to be a college student deep into history or economics just to understand it. All that this book needs is the reader’s absolute attention. It is quite possibly one of the best books of history, Classical History, and economics. The Collapse of Antiquity is worth the time and effort to get and read as well as something worth discussing with friends, family, teachers, and students.

R**Y

Anyone can define a problem. Only the brilliant can come up with a solution. Hudson has.

In my view Michael Hudson is the wisest economic writer in the world today. A casual perusal of the day's headlines will reveal the ongoing collapse of the world's financial system, just as it has dozens of times in the last five thousand years. This is the crisis Janet Yellen said would never happen again yet she's still driving the yacht.According to Michael Hudson in pre-Greek and pre-Roman times the wise leaders in the middle-east would declare a jubilee when debts threatened to explode the financial system. All debts would be forgiven, the farmers could continue to grow food and the economy would recover until another debt bubble threatened the system once again.However in Greek and Roman culture the laws favoured the rich and powerful. When debtors could not pay off their loans they would lost their property to the lenders. Since whenever you are charging interest on loans, the debt is constantly increasing, eventually the rich would end up owning everything. The debtors would be tossed off their land and were reduced to poverty and serfdom.Michael Hudson argues that the Greek/Roman legal system has continued to this day. In Roman times, the debt bomb brought great wealth and power to the 1% but left the 99% poor and angry. Wars, revolutions and a thousand years of the Dark Ages resulted.Once again, through the actions of governments and central banks, the world finds itself awash in a sea of debt. We can continue the road to the ultimate form of debt slavery or a wise leader can declare a debt jubilee. Then and only then can we restart our economy on a rational basis.

J**S

Why you're getting poorer and the rich are getting richer

Ever play Monopoly? Notice that at the end one person owned everything and all other players were bankrupt? You probably never asked why that is the only eventual outcome. and you certainly did not look up and note that the world you live in has the same rules.Michael Hudson did, and wrote a book about how it all got that way. In a fascinating trip back through Bronze Age to ancient Greece, then Rome to illustrate how the rich, the oligarchs, eventually co-opted all other forms of government so that all wealth flows into their hands. It is summed up in two sentences on one of the last pages:"A resilient economy requires restoring balance by public intervention from "above" the market to prevent creditors from impoverishing debtors. But the rentier classes fight to gain control of the the political and law-making sphere and prevent democratic, royal or socialist governments from providing economic resilience by checking their self-seeking."Trigg Adams

T**S

Small Print

I've been following and reading Hudson for decades and looked forward to this book.However, I am older now (75) and need larger print.This book is not available in large print, nor as an ebook where print can be adjusted.I'll just put it on the shelf and wait until either a large print or and ebook becomes available.It's a pity, since his previous books are pretty much all 5 star items.

J**Y

Good product

Good product

M**L

Great Book by a great author

Marvellous book full of insights and historical revelations. Great work, Prof Hudson!

A**T

So etwas hat bislang gefehlt!

Hervorragendes Buch, dass die Probleme der antiken Welt im Spiegel der Verschuldung betrachtet. Dies ist die erste mir bekannte Gesamtdarstellung der antiken Schuldknechtschaft und ihrer Auswirkungen. Auch für den interessierten Laien ohne Probleme les- und verstehbar. Bloss schade, dass dieses Buch vermutlich nach dem Niedergang des gutsortierten Buchhandels weitestgehend ein Schattendasein fristen wird. Auch ich wäre ohne Amazon niemals auf diesen Titel gestossen. Dafür Danke an vielgescholtene Amazon!

P**X

Will we learn from our past?

Detailed history of the rise and fall of ancient Dreece and Rome in the spotlight of debt. Full of interest. The history is fascinating in itself, but also highly relevant to understanding the situation of today in this debt-laden time of Western civilisation endgame. For more on that see MH’s The Destiny of Civilization. All of his books hit the spot. Respect!

Trustpilot

1 month ago

1 week ago